CONTACT: Bailey Dick, bailey [at] jwj.org

November 23, 2015

Washington, D.C. – New data obtained from the U.S. Department of Education show that nearly all of the borrowers eligible for one federal loan forgiveness program remain unenrolled. According to records obtained by Jobs With Justice Education Fund through a Freedom of Information Act request, only 1 percent of potentially eligible borrowers are currently enrolled in the department’s Public Service Loan Forgiveness Program. The findings can be read in the issue brief released today, “The Unmet Promise of Public Service Loan Forgiveness and How to Fix It.”

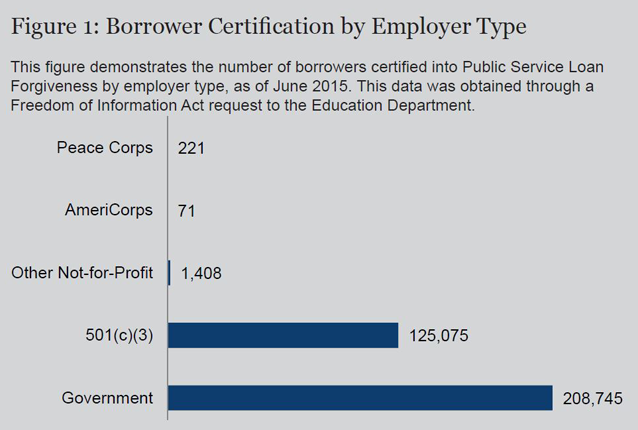

As of June 2015, only 335,520 borrowers were enrolled in the program out of the more than 33 million Americans employed in public service. The Department of Education data also includes a breakdown of the sectors in which enrolled borrowers are employed, which disproves claims that the program is predominately utilized by those employed by nonprofit organizations. Nearly two-thirds of those enrolled in the program are public sector employees like teachers, emergency personnel, social workers and civil servants.

Not only are 99 percent of potential enrollees currently unable to realize the benefits of total, tax-free federal student loan forgiveness, roughly one out of every four certified into the program are currently enrolled in repayment plans that undermine the benefits of the program or that do not qualify due to errors and misinformation provided by loan servicers.

“There has been a systematic failure by the Education Department, as the data we obtained confirms,” said Chris Hicks, Debt-Free Future organizer with Jobs With Justice. “Millions of people who stand to gain tens of thousands of dollars in relief are missing out on this benefit, simply because the Education Department and loan servicers have failed to promote the program at a basic level.”

Potential solutions based on analysis of the data are detailed in the brief, including robust, sustained and tailored outreach to borrowers; reforms to contracts of loan servicers who have failed to provide information about the program; and the creation of safe harbors for borrowers who have been misled by servicers about their eligibility.

###