Over the past three months, Jobs With Justice, Coworker.org, and part-time faculty who are members of AFT 6161 at Palomar Community College campaigned to get Palomar’s administration to take the Consumer Financial Protection Bureau pledge to notify employees about their eligibility in Public Service Loan Forgiveness. On November 13, Palomar took the pledge and emailed every campus worker, telling them not only about their options for debt relief, but also how to lower monthly student loan payments.

Read this update from part-time faculty member Krista Eliot, originally posted on Adjunct Crisis:

This fall, I was part of a group of part-time faculty members of AFT 6161 who launched a campaign calling on Palomar College to take the Consumer Financial Protection Bureau (CFPB) pledge to inform employees of their student loan repayment options and help them apply for loan forgiveness. We posted a petition on Coworker.org and circulated it among our colleagues. With the support of the Palomar Faculty Federation’s executive board, we then took the issue to the Faculty Senate and the college president, Robert Deegan.

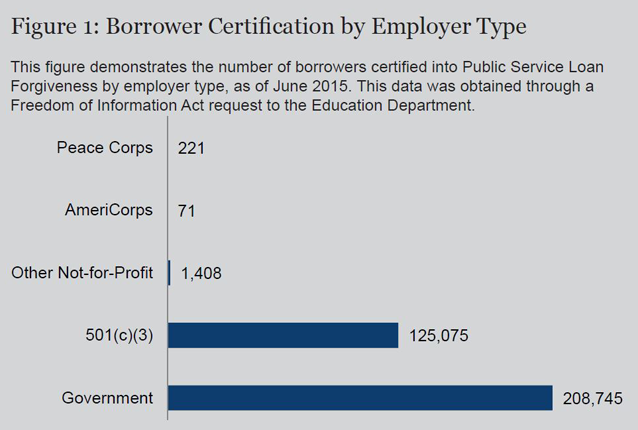

We are thrilled to report that as a result of our efforts, Palomar College has agreed to become the first community college in the country to take the CFPB pledge! By taking this pledge, Palomar can help build awareness of programs that are available to help those campus staff members with high student-loan debt relative to their income. In one such program called Public Service Loan Forgiveness, employees who work for 10 years in public service and make 120 qualifying monthly payments can have any remaining federal student loan debt forgiven.

It’s increasingly critical to get public service organizations (including public school districts, police and fire departments, public hospitals, nonprofits and more) to take the pledge to help their employees explore these flexible repayment options. It can often be a difficult process to apply for income-driven loan repayment and forgiveness programs, particularly Public Service Loan Forgiveness. Adjunct faculty especially face unique challenges, because they are typically defined as part-time employees, not hourly workers, making it difficult to prove that we meet the program’s requirement of working an average of 30 hours per week in public service. But employers can help streamline the application process for their employees by helping them with the paperwork, and the CFPB has developed an “Employer’s Guide to Assisting Employees with Student Loan Repayment” as a resource.

The pledge is critical because many workers who could benefit from these programs are unaware of them. For example, the Income-Based Repayment Program has enrolled less than two million borrowers, despite estimates that millions more are eligible. And seven million borrowers have defaulted on their student loans, despite the presence of such programs. By following Palomar College’s example, other public service organizations can help their employees and build public awareness of the programs available to help borrowers manage their student loan debt.

To learn more about what you can do, use these links!

Guide for Public Service Employees:

Explore your loan forgiveness options with this action guide for public service employees.

Ask Your Employer to Take the Pledge:

Ask your employer to take the CFPB’s pledge to work with you and your coworkers to qualify for loan forgiveness. If your employer takes the pledge, we’ll send them a toolkit to get started. You can also ask find out more information about your options. Visit www.consumerfinance.gov/pledge.

Submit a Complaint:

Have an issue with your servicer or debt collector? We’ll forward your complaint to the company and work to get a response from them. Visit consumerfinance.gov/complaint.