One in five American households holds education debt,i posing an increasingly large threat to our economic recovery. As politicians at the federal, state and local levels consider possible solutions to this growing crisis, one government agency finds itself at the center of the student loan debate. The U.S. Department of Education lends borrowers more than $100 billion in student loans annually but continues to fall down on the job when it comes to administering those loans and helping borrowers actually get out of debt. Read on for some surprising facts about the agency’s role as a major player in the student loan business – or download the fact sheet.

1. The Department of Education currently holds enough assets to be one of the country’s 10 largest banks, yet it lacks the capacity and infrastructure necessary to manage them effectively.ii With a total of $757.4 billion in receivables (loans, fees and interest) through its student loan business, only six banks report having more assets than the Department of Education at the end of 2013.iii The agency’s own Inspector General, Kathleen Tighe, has recently called for strong oversight of the Department of Education given its sizable portfolio. In testimony before a House Committee on Education and the Workforce subcommittee, she said: “Through its Federal Student Aid office (FSA), the Department disburses approximately $140 billion in student aid annually and manages an outstanding loan portfolio of $1 trillion. This makes it one of the largest financial institutions in the country. As such, effective oversight and monitoring of its operations are critical.”iv

2. In 2013, the agency made a profit of $41.3 billion off of federal student loans – higher than all but two companies in the world, Exxon Mobil and Apple – and enough to provide the maximum Pell Grant award to seven million students.v According to the U.S. Student Debt Relief organization, “Profit from student loan payment interest is supposed to cover administration costs and provide grant money to those who qualify. This is not the case anymore.”vi

3. The Department of Education currently has a portfolio of $1.1 trillion in student loans, making up the bulk of the reported $1.2 trillion of all student debt in the United States.vii The Consumer Financial Protection Bureau (CFPB) reported that in 2011 alone, the Department of Education provided $117 billion in federal student loans.viii In other words, the agency owns nearly all of the student debt in this country but outsources the management and administration of it to private banks whose performance and operations it barely monitors. In 2013 alone, the agency received 33,916 complaints about those banks from borrowers.ix

4. More than 40 million people are in debt to the Department of Education as of 2013.x This number is growing every year, as 71 percent of the 2012 graduating college students took out student loans to cover the cost of their education.xi Improving college affordability and helping borrowers reduce their debt are conspicuously absent from the department’s mission – and its website, which makes almost no mention of potential solutions for borrowers who are struggling. Yet the agency still claims to promote access to higher education, despite functioning essentially as a big bank, condemning borrowers to a lifetime of debt in order to achieve that education.

5. In 2012, the default rate on federal student loans was the highest recorded rate in 20 years.xii One in every seven student debtors holding federal student loans went into default within three years of graduation. Overall, there are more than seven million student debtors in default on their student loans, some of whom took out what they thought were “good” federal loans, only to have those loans outsourced to banks looking for profits.

6. Of the 40 million borrowers who hold federal student debt, 8.3 percent were at least 90 days behind on their payments in 2013.xiii According to the Federal Reserve Bank of New York, borrowers are more likely to be delinquent on their student loans than any other type of consumer debt. In the face of these record default and delinquency rates, the department continues to lend money at a record pace, with minimal investment in programs to make college more affordable and debt more manageable.xiv

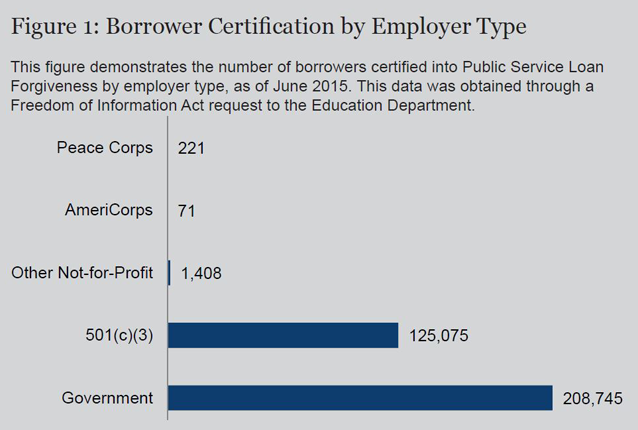

7. Only 1.6 million federal student debtors are enrolled in the agency’s income-driven repayment program,xv despite 33 million – a full quarter of our country’s workforce – being eligible for such programs. These repayment plans were designed to prevent defaults and delinquencies by negotiating flexible repayment options based on a borrower’s financial situation. And yet the department has only informed 3.5 million borrowers directly about their eligibility to enroll. By not communicating with borrowers about this loan assistance program, the department appears to be prioritizing its profits at the expense of borrowers.xvi

8. The Department of Education erroneously categorized tens of thousands of loans as in default for over a year longer than they actually were – all because of backlogs and problems with their own debt management system.xvii The Government Accountability Office (GAO) found that these borrowers were then unable to have the default removed from their credit report, impacting their ability to secure housing and employment.xviii The agency’s Inspector General indicated that the problems arose from the department’s “apparent lack of oversight and monitoring of this system.”xix

9. The Department of Education itself has found that many of its contractors are not compliant with the customer service and reporting standards stipulated in their contracts, yet has refused to hold those banks accountable or impose any consequences.xx In a 2013 letter to Senator Elizabeth Warren (D-Mass.), the agency admitted to finding that one of its largest private contractors, Sallie Mae, faced accounting errors, incorrect billing statements and an unpaid debt of $22.3 million to the Department of Education. Senator Warren went so far to say that the agency was risking becoming a “lapdog” to financial companies with its continued failure to address these issues.xxi

10. While the Department of Education may have a lax oversight record, the agency has aggressive practices in place to collect on default and or delinquent loans by garnishing tax refunds and Social Security payments. As The New York Times reported in February 2014, “One thing the federal student loan program does not lack is ways to collect the money. Bankruptcy will usually not cancel student loans, and the government has the power to seize income tax refunds and garnish wages as needed. Some parents who guaranteed student loans that have defaulted find the money taken out of their Social Security checks.”xxii

As our nation’s stack of unpaid student loan bills continues to grow, there is no federal agency with greater authority to rein in this crisis than the U.S. Department of Education. Instead, the department remains complicit in the for-profit student loan business, continuing to operate like a corporate bank and shirk its oversight and enforcement responsibilities at the expense of tens of millions of borrowers.

Download the fact sheet: The Student Debt Crisis and the U.S. Department of Education: How a Government Agency Shirks Oversight Responsibility and Operates Like a Big Bank

[x] http://docs.house.gov/meetings/ED/ED13/20140312/101885/HHRG-113-ED13-Wstate-RuncieJ-20140312.pdf

[xvi] http://www.insidehighered.com/news/2013/11/04/education-dept-will-email-35-million-student-loan-borrowers-about-income-based

While our president is spending millions of dollars on

family vacations and the government allows New York to gut the Medicaid system

with medically unnecessary home care services, families in middle class America

are being crushed with unbearable interest rates of student loan debt. The

Department of Education is making billions of dollars, while those of us with

student loan debt wake up every day filled with anxiety, fear, and desperation.

We have no alternatives and no way out.

Every day I search for places to post my story. I have written every

governor, congressman, and senator in the United States. Every day I send

messages to the press, the big PACs, and popular news shows. I have contacted

the Ombudsmen and Consumer Financial Protection Bureau.

My congressman has told me there will likely be no action on

this topic for some years. I have spoken to my governor and the State

Department of Higher Education. Everyone states ‘I am sorry, but it’s in the

hands of congress- there’s nothing I can do’.

I and another million people will not make it through the year. I am 55

years old. I do not have years to wait for change.

The Federal Department of Education is perpetuating a

despicable scam. Students are allowed a small portion of tuition in loans and

before they are given enough for tuition the parent is required to apply for

parents plus loans. The ‘denied’ parents are the lucky ones. As, the parent who

is ‘accepted’ takes on the student’s remain tuition debt but is denied the same

repayment plans that would have been available to the student and are penalized

by an 8% interest rate. This scam brings significant additional funds to the

department of education and loan servicers. While FHA 30 year mortgages are at

3.37% the interest charged is more than double the market price.

This process is discriminatory and causes significant

hardship on middle class parents. I have both student loans (went back to

college) and I was forced to take out parents plus loans for my children. I owe

180,000.00 in consolidated student loan debt, and the interest rate is 7.5%. If

I were allowed to consolidate under income based repayment, my monthly payment

would be $700.00. But the Department of Education excludes me from this payment

option. Under income contingent repayment my monthly repayment soars to

$1200.00 per month even though the loan total is the same. The forced parent

plus application unfairly singles out parents, discriminating against them by

predatory interest rates and denial of attractive repayment plans.

The recent Senate HELP committee hearing was spent

discussing the Department of Education’s profits made off student debt, a

reported $41.3 billion in 2013. PROFITS made off the lives of hard working

middle class people. These profits have stolen our hope, our futures, and our

dignity. We cannot afford this burden. These profits go to further ‘fund’ the

government’s egregious spending, pay big salaries, and retirement pensions. We

cannot buy any extras, we don’t go on any vacations, and there is no retirement

pension check for retirement. We barely get by. You can blame it on the high

tuition rates, you can blame it on naïve students and parents, but know that

you have the power to help and that places the ultimate responsibility for our salvation

or our destruction in your hands. I pray every night that my voice will be

heard, changes will be made now, and relief will come before it is too late.