With more than 40 million student debt borrowers and millions of co-signers struggling to make ends meet, it’s clear that this is one of the biggest hurdles working families face today.

Student debt has passed the $1 trillion dollar mark. It has overtaken credit card debt and auto-loan debt. Two-thirds of students walk across the graduation stage with a diploma in one hand and a bill in the other, at an average of nearly $27,000. When they get home, they’ll most likely be met with a call from a debt collector (whose is earning only a dollar or two away from minimum wage). For recent graduates who start making payments on their loans, nearly one in eight will enter default within two years. Imagine trying to save for a house with this burden on your shoulders.

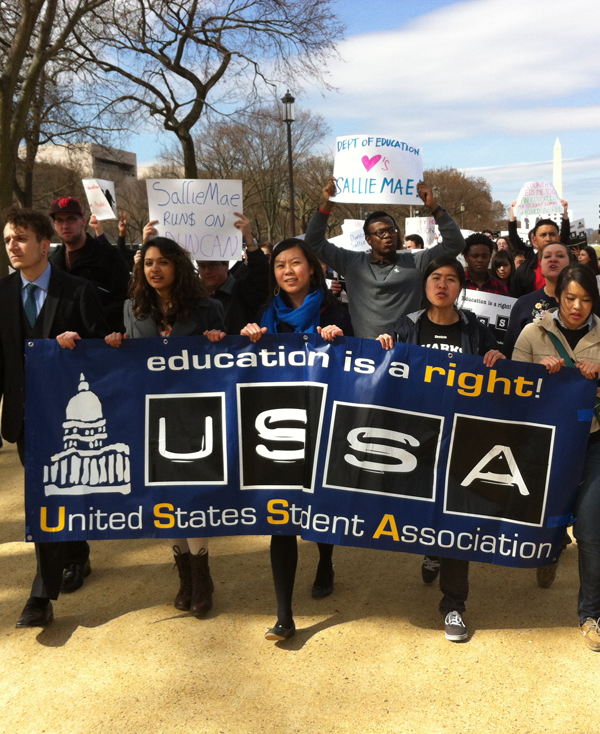

But at a time when it seems like higher education is in complete crisis, there is still room for hope. With more than 40 million student debt borrowers and millions of co-signers struggling to make ends meet, it’s clear that this is an issue that crosses nearly all political lines and is one of the biggest hurdles working families face today. In partnership with the US Student Association, Jobs With Justice is working to make college more affordable, rein in student lenders through stronger regulations, and win debt relief for all working families.

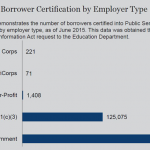

Check out our new website, ForgiveMyStudentDebt.org, which provides detailed information about the existing but low-profile programs that exist to reduce monthly payments and even forgive outstanding debt!